Post Categories

Energy Storage Cell Shortage: How Technology and Policy Are Reshaping the Global Market

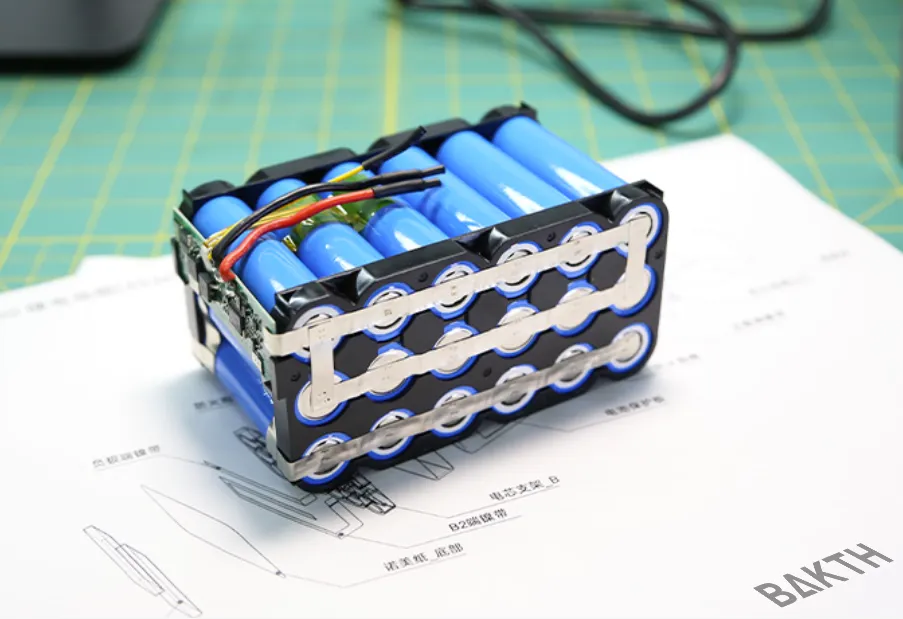

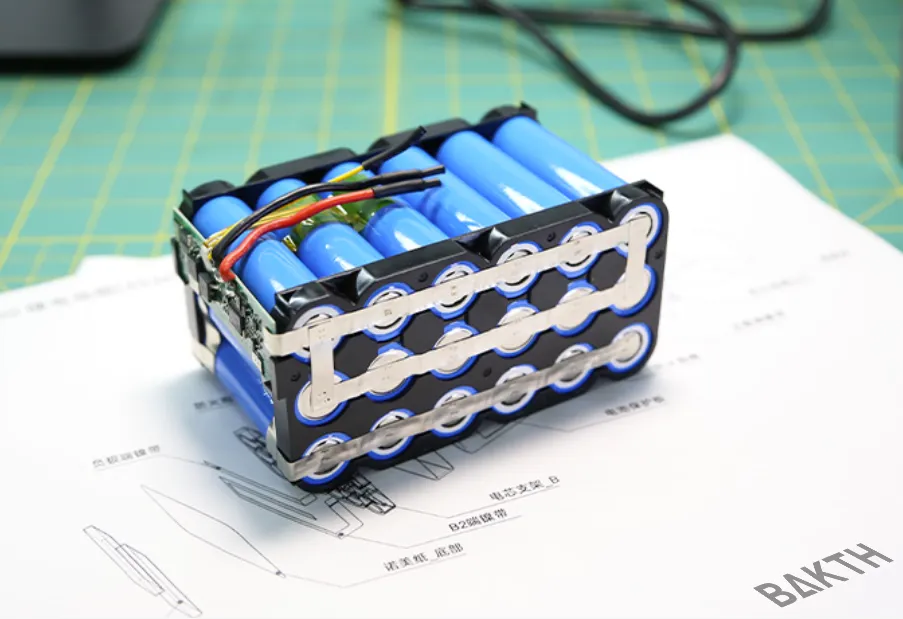

A perfect storm of policy incentives and technological advancement has led to a severe shortage of energy storage cells, leaving integrators worldwide scrambling for supply. Orders are backed up until 2026, and manufacturers are prioritizing clients who adopt their latest technology standards.

“It’s a seller’s market. You don’t choose the cell—the cell chooses you,” remarked a project developer in Australia.

Policy Waves and Market Ripples

China’s “136 policy” has been a key demand driver, but it’s not alone. In the U.S., the Inflation Reduction Act (IRA) continues to spur energy storage deployments, while the European Green Deal has prompted several member states to introduce storage mandates for renewable projects.

Meanwhile, emerging markets like Chile, South Africa, and Saudi Arabia are making large-scale investments in storage to stabilize their grids and reduce diesel dependency.

Supply-Side Challenges

While demand soars, cell production isn’t keeping up. Many battery makers had scaled back expansion plans during the 2024 oversupply period. Now, they’re playing catch-up. It takes 12–18 months to build and commission a new cell factory, creating a natural lag.

Moreover, the industry is experiencing a material bottleneck. Lithium carbonate prices have climbed by 25% over the past six months, and shortages of high-grade lithium iron phosphate (LFP) are also being reported.

Innovation as a Differentiator

To secure cells, many system integrators are entering into technology collaboration agreements. EVE Energy’s “CLS” program, for example, offers guaranteed supply to partners who adopt its battery design, BMS, and software protocols.

At the same time, larger cells are redefining the industry. CATL’s 587Ah cell is already in mass production, and REPT and HiNA Battery are also launching 500Ah+ products. These cells reduce system costs and improve longevity, but their complexity limits how quickly they can be manufactured.

The Road to 2027

Governments are taking note. China recently released a three-year plan aiming for over 180 GW of energy storage by 2027. Similar targets are being discussed in the E.U. and U.S.

However, industry leaders warn that without greater investment in raw material mining, refining, and cell production, the shortage could persist beyond 2026. The message is clear: the energy transition depends on a secure and scalable battery supply chain.

A perfect storm of policy incentives and technological advancement has led to a severe shortage of energy storage cells, leaving integrators worldwide scrambling for supply. Orders are backed up until 2026, and manufacturers are prioritizing clients who adopt their latest technology standards.

“It’s a seller’s market. You don’t choose the cell—the cell chooses you,” remarked a project developer in Australia.

Policy Waves and Market Ripples

China’s “136 policy” has been a key demand driver, but it’s not alone. In the U.S., the Inflation Reduction Act (IRA) continues to spur energy storage deployments, while the European Green Deal has prompted several member states to introduce storage mandates for renewable projects.

Meanwhile, emerging markets like Chile, South Africa, and Saudi Arabia are making large-scale investments in storage to stabilize their grids and reduce diesel dependency.

Supply-Side Challenges

While demand soars, cell production isn’t keeping up. Many battery makers had scaled back expansion plans during the 2024 oversupply period. Now, they’re playing catch-up. It takes 12–18 months to build and commission a new cell factory, creating a natural lag.

Moreover, the industry is experiencing a material bottleneck. Lithium carbonate prices have climbed by 25% over the past six months, and shortages of high-grade lithium iron phosphate (LFP) are also being reported.

Innovation as a Differentiator

To secure cells, many system integrators are entering into technology collaboration agreements. EVE Energy’s “CLS” program, for example, offers guaranteed supply to partners who adopt its battery design, BMS, and software protocols.

At the same time, larger cells are redefining the industry. CATL’s 587Ah cell is already in mass production, and REPT and HiNA Battery are also launching 500Ah+ products. These cells reduce system costs and improve longevity, but their complexity limits how quickly they can be manufactured.

The Road to 2027

Governments are taking note. China recently released a three-year plan aiming for over 180 GW of energy storage by 2027. Similar targets are being discussed in the E.U. and U.S.

However, industry leaders warn that without greater investment in raw material mining, refining, and cell production, the shortage could persist beyond 2026. The message is clear: the energy transition depends on a secure and scalable battery supply chain.